- E-Invoice Management Software

- Invoicing Management Software

- Inventory Management Software

- Accounting Management Software

- Online Order Booking Application

- Accurate & Precise Reports

- Attendance Tracking

- Promotions Management

- Sales Order Management

- Inventory Distribution Management

- Load Form Management

Latest Post

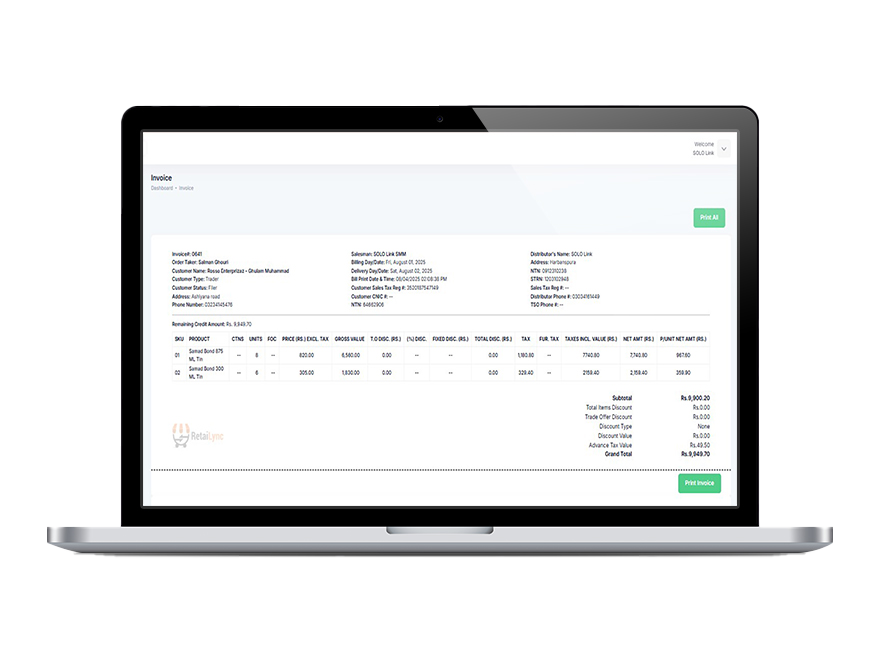

RetaiLync’s Fully GST‑Compliant E‑Invoice System

Instantly generate legally valid digital invoices with customer details—fully aligned with Pakistan’s tax structure. Ensure compliance, reduce manual effort, and manage your entire invoicing workflow seamlessly within one app.

What we do

RetaiLync automates the entire digital invoicing process—creation, storage, dispatch, and tracking—helping you meet Pakistan’s sales tax requirements and streamline your billing operations.

Generate structured digital invoices with QR codes and customer details.

Submit invoices instantly to your records—no manual paperwork required.

Track invoice status and identify errors in real time.

Handle cancellations and update records without compliance risk.

What we offer

RetaiLync brings you a complete e‑Invoicing solution with:

QR Code Generation

Generate digital invoices with secure QR codes containing invoice number, customer details, and tax summary—fully aligned with Pakistan’s sales tax requirements.

Auto Saving to Secure Records

Invoices are instantly saved within RetaiLync’s secure system—no manual uploads or paperwork—ensuring easy access for audits, reporting, and tax compliance in Pakistan.

Validation & Error Handling

Get immediate feedback on rejections, with in-app options to correct and resubmit.

e‑Way Bill Linkage

Generate and attach e‑Way Bills for interstate movements directly from the invoice module.

Real-Time Dashboard

Monitor status of all e‑Invoices—submitted, pending, errored, or cancelled.

Secure Archival & Reporting

All records stored and audit-ready, including cancellations and adjustments.

Frequently Asked Questions

A digitally generated invoice that includes customer details, itemized sales, applied taxes, and a QR code. It complies with Pakistan’s sales tax regulations and ensures transparency, accuracy, and audit readiness for businesses of all sizes.

Businesses registered with Pakistan’s sales tax system, especially those using integrated POS systems or operating at scale (such as retailers, wholesalers, and distributors), should issue digital invoices to maintain compliance, improve transparency, and stay audit-ready.

Instant processing and improved cash flow

Elimination of manual input errors

Reduced costs (paper, printing, postage)

Stronger compliance and audit trails

Yes. You can cancel or edit digital invoices directly within RetaiLync and generate revised versions with updated details—ensuring your sales records remain accurate and compliant with Pakistan’s tax regulations.